To maximize the value of your investment, it's important to know the pricing of AI software that predicts and analyzes stocks. Pricing structures vary widely, and understanding the price you're paying is key to making an informed decision. These are the top 10 guidelines for evaluating costs and pricing:

1. Learn about the pricing model

Subscription-based: Check whether the platform is charged monthly or annually and what features are included in each tier.

Pay-per-use : Verify that the platform charges according to the usage (e.g. transactions, requests for information or forecasts).

Freemium: Check whether a platform offers an unrestricted free tier or costs extra for premium features.

2. Compare Pricing Levels

The features offered in each price level (e.g. basic professional, professional, or enterprise).

Scalability: Ensure that your pricing levels are in line with your requirements, regardless of whether you're a solo trader or professional.

Upgrade flexibility: Determine if your plan can be easily upgraded or downgraded when your needs evolve.

3. Evaluate Hidden Costs

Data fees: Verify whether the platform is charging extra for access to premium data (e.g. real-time data and advanced analytics).

Brokerage charges - Check to find out if additional costs are charged by the platform for execution of trades, or integration with brokers.

API use: Find out if you will be charged additional fees for frequent API use or API access.

4. Check out free demos and trials

Trial period - Search for platforms which offer a demo or free trial to let you check out the features before deciding to make a decision to commit.

Check the limitations on the free trial. It may not have all of its features.

No-commitment options: Ensure you are able to end the trial without having to pay if the platform doesn't meet your needs.

5. Be sure to check for discounts and promotions.

Discounts for annual subscriptions: Find out whether your platform offers discounts on subscriptions that are paid annually, compared to plans that are billed monthly.

Referral Programs Check if your platform offers discounts or credits for users who refer others to it.

Ask about bulk or institutional pricing if your company is large.

6. Review the Return on the investment

Cost vs. value - Decide whether the capabilities, features, and predictions are worth it. It can save you money or make better trading decisions.

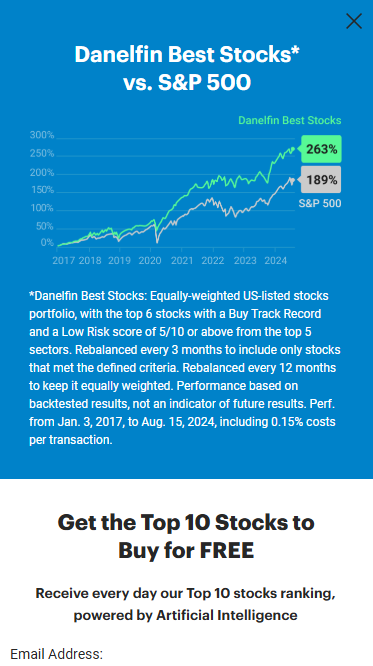

Research the platform's success rate or testimonials from users to assess its potential return on investment.

Alternative costs Costs of the platform: Compare its cost to the potential cost of not using it (e.g., missed opportunities, time spent on manual analysis).

Review Cancellation/Refund Policies

Terms of cancellation: Make sure you are able to cancel your subscription without penalty or hidden charges.

Check the refund policy to see if you can get an amount of money back for any unredeemed subscription portion.

Auto-renewal. Verify if the platform will automatically renew your account. If it does you'll need to find out how to stop it.

8. Transparency in Pricing:

A clear pricing page - Make sure there aren't any hidden fees on the pricing page.

Customer support: Call customer service to clarify any pricing issues or costs.

Contract Terms: Read the contract terms to determine whether there are penalties or long-term obligations.

9. Compare with Competitors

Comparing the features and costs of the platforms against those of their competitors will help you get the best deal.

User reviews: Look at user feedback to find out whether the platform's price is justified.

Check the market positioning of the platform. Does it fit your requirements?

10. Calculate the Long-Term Costs

Price increases: Determine whether there is a pattern of price increases and how often they occur.

Feature additions - Determine whether new features are included in your current plan or if an upgrade is required.

Cost of scaling The platform needs to be priced appropriately in the event that your trading or data requirements rise.

Bonus Tips

Test different platforms. You can test a variety of platforms for free to test them and compare them.

Negotiate your pricing. If you're a part of a larger organization or use the product in large amounts, discuss pricing options that are custom.

You should look into educational resources. A lot of platforms offer free educational tools or materials, which can be a great addition to their main features.

The following tips can aid you in evaluating the price and cost of AI analysis and stock prediction platforms. It is possible to pick one that is suitable for your budget and provides the features you need. A platform that is priced correctly will strike the right equilibrium between affordability, functional and performance in order to optimize your trading. Follow the most popular trading with ai for site tips including ai investing, ai trading, market ai, ai for trading, ai investment platform, market ai, AI stocks, best ai trading software, ai for investing, AI stocks and more.

Top 10 Tips To Assess The Transparency Of Stock Trading Platforms

Transparency plays a crucial role in assessing AI-driven trading and platform for stock predictions. Transparency is essential because it allows users to trust the platform, be aware of the choices made, and check the accuracy. Here are the top 10 tips for assessing transparency in such platforms.

1. A Clear Explanation on AI Models

Tip: Check if the platform gives a clear explanation of the AI algorithms and models used to predict.

The reason: Understanding the basic technology can help users evaluate its validity and weaknesses.

2. Disclosure of Data Source

Tips: Check if the platform is transparent about the sources of its data (e.g., historical stock information, news, social media, etc.).

The reason is that knowing the source of data ensures that the platform is able to use reliable and complete information.

3. Performance Metrics & Backtesting Results

Tip - Look for clear reporting on the performance metrics like accuracy rate, ROI and backtesting.

The reason: It lets users verify the effectiveness of the platform and its historical performance.

4. Updates, notifications and real-time updates

Tips: Make sure you can get real-time notifications and updates on trading, predictions or other modifications to the system.

The reason: Real-time transparency allows users to be informed of all critical actions.

5. Transparency in Communication regarding Limitations

Tip: Check if the platform openly discusses the limitations and risks of its trading strategies.

Why: Acknowledging limitations builds trust and allows users to make better choices.

6. Raw Data Access for Users

Tip: Determine if the AI model can be used to access raw data, intermediate results or both.

How do they do it? Users are able to perform their own analysis and validate predictions by accessing the raw data.

7. Transparency about fees and charges

Be sure that the platform clearly lists all subscription fees and other hidden costs.

Why: Transparent pricing prevents cost-insane surprises and helps build confidence.

8. Regularly reporting and performing audits

Find out if the platform produces regular reports or is subject to audits conducted by third parties to check the platform's performance.

Why: Independent verification increases the credibility of your business and increases accountability.

9. Explainability of predictions

TIP: Find out if the platform has information on how predictions or recommendations (e.g. feature importance and decision tree) are generated.

Why: Explainability helps you comprehend AI-driven decisions.

10. User Feedback and Support Channels

Tip: Check whether the platform has open channels for feedback from its users and provides assistance. You should also check whether it responds to user complaints in a transparent manner.

Why? Responsive communication shows the commitment to transparency and satisfaction of users.

Bonus Tip: Regulatory Compliance

Check that the platform meets all financial rules. It must also reveal the status of its compliance. It adds an additional layer of trustworthiness and transparency.

Through a thorough examination of these factors you will be able to judge whether an AI trading and stock prediction platform operates in a transparent manner, allowing you to make informed decisions and gain confidence in its capabilities. Check out the recommended full report on chart ai trading for site advice including stocks ai, chart analysis ai, can ai predict stock market, ai options, how to use ai for stock trading, ai trading tool, stocks ai, best stock prediction website, ai copyright signals, investing with ai and more.